san fran sales tax rate

San Francisco Accra Ghana. Walk-ins for assistance accepted until 4 pm.

The December 2020 total local sales tax rate was 8500.

. The latest sales tax rate for San Francisco County CA. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. This rate includes any state county city and local sales taxes.

The business registration is then renewed in May on an annual basis. Here is the standard clause governing closing costs in the SFAR purchase contract Revise. The Office of the Treasurer Tax Collector collects business various taxes and fees that are required.

In San Francisco the tax rate will rise from 85 to 8625. San Francisco voters approved the tax in Nov. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

Ad Download tables for tax rate by state or look up sales tax rates by individual address. The County sales tax rate is 025. The December 2019 total local sales tax rate was also 8500.

4 rows San Francisco CA Sales Tax Rate The current total local sales tax rate in San Francisco. Method to calculate San Francisco County sales tax in. Most of these tax changes were approved by.

San Francisco City Hall is open to the public. The average sales tax rate in California is 8551. 1788 rows California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated.

There is no applicable city tax. For sellers closing costs usually run in the range of 6 to 7 of the sales price not including loan pay-off and any significant home preparation staging or repair costs. For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage.

Learn about the Citys property taxes. The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025 county sales tax and a 225 special district sales tax used to fund transportation districts local attractions etc. The Office of the Treasurer Tax Collector is open from 8 am.

1000000 or more but less than 5000000. This rate includes any state county city and local sales taxes. The California state sales tax rate is currently 6.

The minimum combined 2022 sales tax rate for San Francisco County California is 863. San Franciscos Business and Tax Regulations Code requires that every person engaging in business within the City must register within 15 days after commencing business. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax.

Method to calculate San Francisco County sales tax in 2021. The December 2020 total local sales tax rate was 8500. Typically the largest seller costs are brokerage commissions and transfer taxes.

How much is sales tax in San Francisco. The average sales tax rate in California is 8551. California has a 6 sales tax and San Francisco County collects an additional 025 so the minimum sales tax rate in San Francisco County is 625 not including any city or special district taxes.

City Hall Office Hours. 2020 rates included for use while preparing your income tax deduction. The 2018 United States Supreme Court decision in South Dakota v.

Method to calculate San Francisco sales tax in 2021. The average sales tax rate in California is 8551. This is the total of state county and city sales tax rates.

The San Francisco County Sales Tax is collected by the merchant on all. Monday through Friday in room 140. The Sales and Use tax is rising across California including in San Francisco County.

We also provide tools to help businesses grow network and hire. Access and view your bill online learn about the different payment options and how to get assistance form the Citys Treasurer Tax Collector Office. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375.

This is the total of state county and city sales tax rates. Rate tables and calculator are available free from Avalara. The minimum combined sales tax rate for San Francisco California is 85.

This is the total of state and county sales tax rates. 2018 which imposes a 1 percent to 5 percent citywide tax on gross receipts from cannabis. Depending on the zipcode the sales tax rate of san francisco may vary.

2020 rates included for use while preparing your income tax deduction. The San Francisco County sales tax rate is 025. The total sales tax rate in any given location can be broken down into state county city and special district rates.

California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County Acampo 7750 San Joaquin Acton 9500 Los Angeles Adelaida 7250 San Luis Obispo Adelanto 7750 San Bernardino Adin 7250 Modoc Agoura 9500 Los Angeles Agoura Hills 9500 Los Angeles. The sales tax jurisdiction name is San Francisco Tourism Improvement District which may refer to a local government division. The California sales tax rate is currently 6.

The South San Francisco California sales tax is 925 consisting of 600 California state sales tax and 325 South San Francisco local sales taxesThe local sales tax consists of a 025 county sales tax a 050 city sales tax and a 250 special district sales tax used to fund transportation districts local attractions etc. Payments at the cashier window accepted until 5 pm. The San Francisco Business Times features local business news about San Francisco.

The latest sales tax rate for San Francisco CA. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

Understanding California S Sales Tax

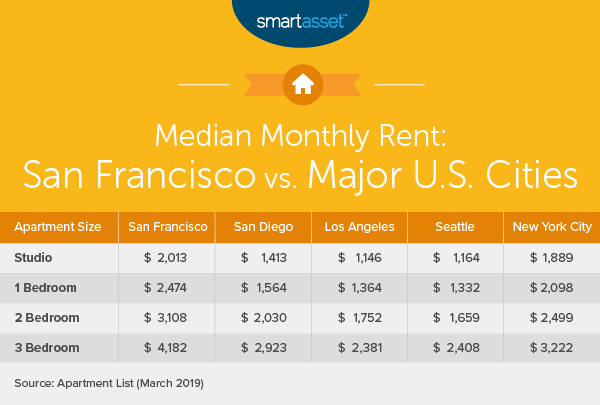

What Is The True Cost Of Living In San Francisco Smartasset

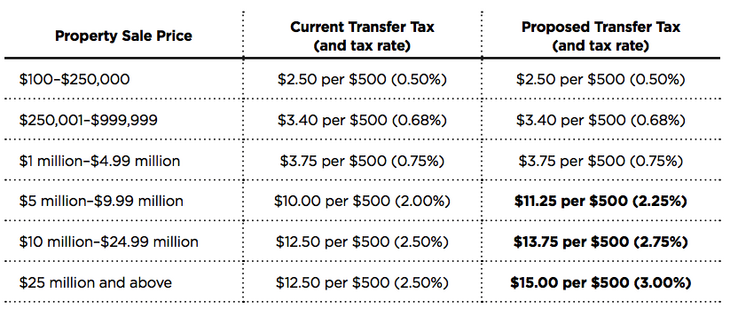

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

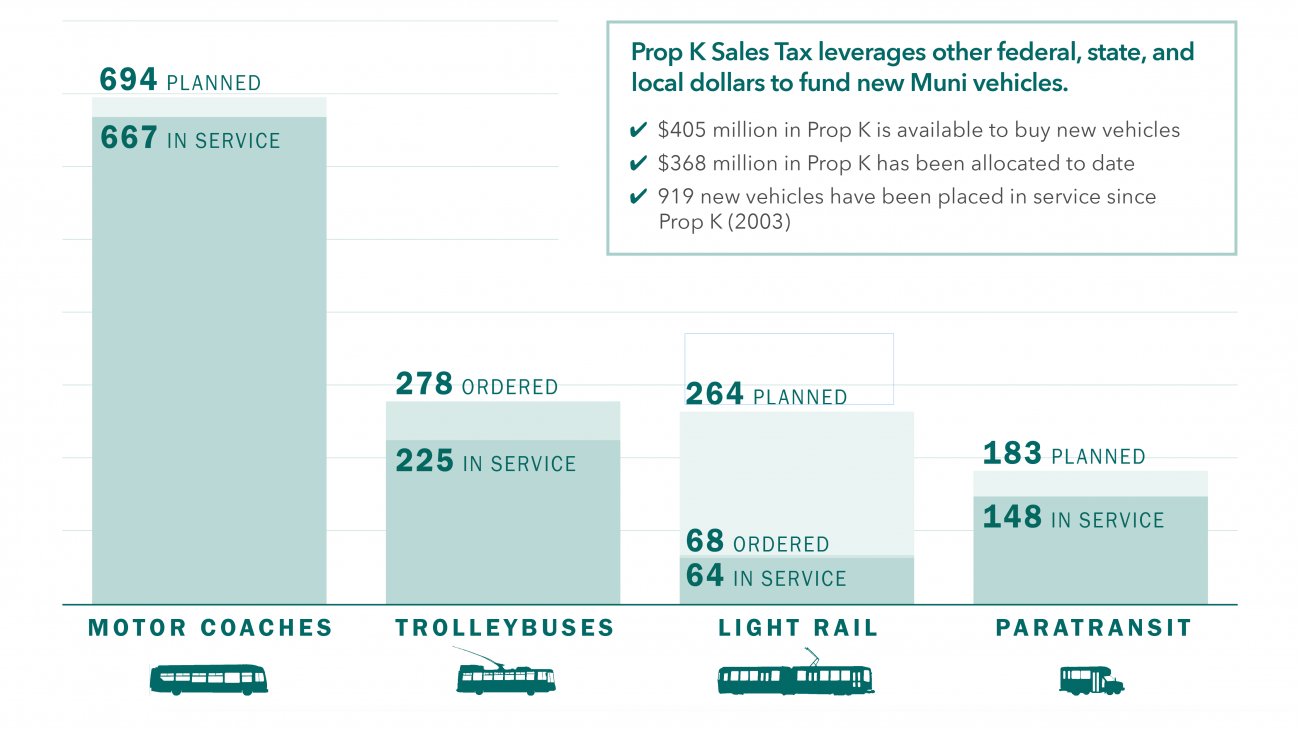

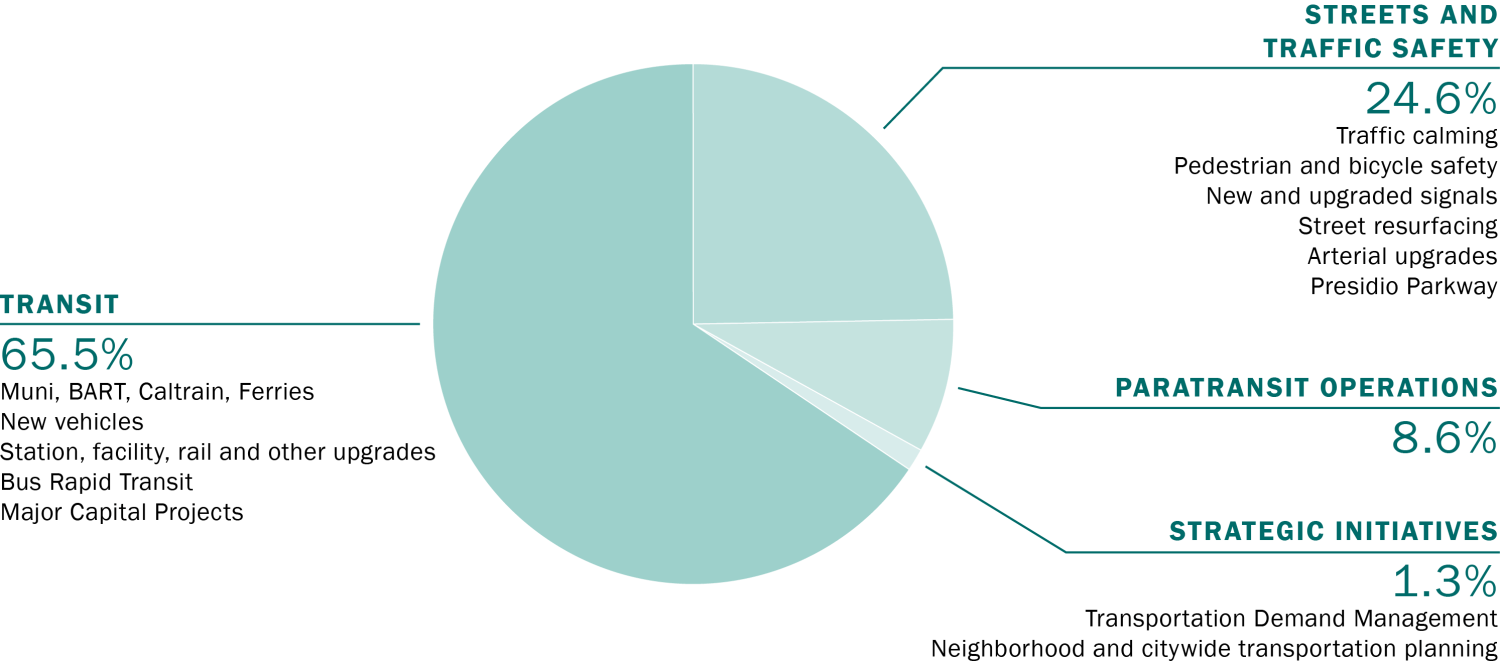

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

Sales Tax Collections City Performance Scorecards

San Francisco Taxes Where Does The Money Go By Michael Sutyak Medium

/buying-vs-renting-san-francisco-bay-area-ADD-V2-d0efaf2b7ac346bbba2c1ac389751ef1.jpg)

Buying Vs Renting In San Francisco What S The Difference

San Francisco Prop W Transfer Tax Spur

San Francisco Prop W Transfer Tax Spur

California Sales Tax Rates By City County 2022

Understanding California S Sales Tax

San Francisco Taxes Where Does The Money Go By Michael Sutyak Medium

No April Fools Joke City Sales Tax Rises To 10 25 April 1 El Cerrito Ca Patch

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur